Offshore Banking in the UK is a bit of a misnomer. While non-residents can bank in the United Kingdom, offshore banking in the UK is found… offshore.

Just a short 60-minute flight from London, and you can find three of the top offshore banking jurisdictions in existence today: the Crown Dependencies of Jersey, Guernsey, and the Isle of Man.

These three little island territories are not part of the UK. Instead, they are territories for which the UK is responsible. This makes the Crown Dependencies unique when compared to the British Overseas Territories (BOTs), which are constitutionally tied to the UK.

And, to top it off, these three banking jurisdictions offer accessible investment services, private banking, wealth management, and other expat banking products.

KEY TAKEAWAYS

- Choosing where to open an offshore account in the UK can be challenging to navigate if you don’t have the right information

- It’s important to understand the bank-specific requirements and banking regulations before applying to open an offshore account in the UK

- There are several banking options in the BOTs to choose from that are suitable for non-resident banking clients

- Deposit amounts will vary between banking jurisdictions, banks, and even branches

- International banking products and services available to your client profile will depend on where you choose to open accounts

Of course, BOTs can offer interesting banking options as well. In fact, these territories include some of the most popular banking hubs today, including the Cayman Islands, Bermuda, the British Virgin Islands, Anguilla, and Gibraltar.

Account opening requirements vary widely across these jurisdictions, from easier opening in the Isle of Man and Jersey to more complicated account opening in the Cayman Islands and Gibraltar. In short, while these jurisdictions may not be as challenging to open accounts as the UAE, they are not as easy as other places like the US, for example.

In this article, we’ll explore both categories of banking offshore in the UK: the Crown Dependencies and the British Overseas Territories. This will include an overview of the banking options, the types of clients each territory caters to, restrictions tied to UK banking due to ringfencing, and how you can start opening accounts today.

Feel free to use the table of contents to jump ahead to the sections most relevant to you.

Table of Contents

- Opening Offshore Accounts in the UK

- Where to Start With Opening a UK Bank Account

- Offshore Banking in Guernsey

- International Banking in the Isle of Man

- Opening Offshore Accounts in Jersey

- Opening an Offshore Account in Anguilla

- Opening an Offshore Account in Bermuda

- Banking Offshore in the British Virgin Islands

- Banking Offshore in the Cayman Islands

- Banking Offshore in Gibraltar

- Frequently Asked UK Offshore Banking Questions

- Do You Want Help Opening Offshore Bank Accounts

Opening Offshore Accounts in the UK

The City of London is entirely responsible for the offshore banking industry in the Crown Dependencies and BOTs. In fact, if it wasn’t for the City, many of these islands would still be rural agricultural outposts, or maybe territories of Amsterdam or the US instead.

It all started when the City expanded in the mid-1900s. That’s when London bankers established financial centers in the Caribbean, the Indian Ocean, and even closer to home in the Irish Sea and the English Channel.

These financial outposts were not only extensions of the British Empire, they propelled British finance ahead of the global competition — ensuring that the City of London was always a few steps ahead of the rest of the world.

In fact, it’s no stretch of the imagination to say that the entire offshore financial system was engineered and steered from the beating heart of UK finance, London — though historically, the City would deny such influence.

Then, after Britain proved its model for offshore finance, other nations such as the Netherlands, France, and the US began to mimic their efforts. This created a global network of banking offshore and corporate registration that ushered in a new world of tax efficiency, asset protection, and high finance.

Today, many of the “benefits” that originally attracted people to these islands (e.g., tax evasion, anonymous companies, banking secrecy, and more), no longer exist. This is the direct result of banking secrecy being torn to shreds, the introduction of information-sharing agreements (e.g., FATCA, CRS, AEOI), the global obsession with public registries (thanks to the Panama Papers scandal), and stiffer regulations around the world.

But, don’t worry, opening bank accounts offshore through the UK (and its territories) still offers plenty of opportunities. In fact, clients with the right information can still protect their assets, increase tax efficiencies, and even obtain second passports… all from an offshore bank account.

Do You Want to Explore All Your Offshore Banking Options?

Where to Start With Opening a UK Bank Account

Today, despite their historical and constitutional ties, the territories that make up the Crown Dependencies and BOTs compete directly with one another. They compete to attract financial institutions, professional service providers, law firms, investment funds, insurance behemoths, multinationals, trusts, and of course, customers for all of the above. These are the essential ingredients that keep their island economies humming.

Of course, certain islands have carved out key areas of expertise, insulating them from direct competition. For example…

Cayman has developed a knack for attracting bank booking centers and major hedge funds. This has resulted in it becoming the fifth-largest banking sector in the world. Today, Cayman has over US 1.9 trillion in deposits.

The British Virgin Islands has become the company registration jurisdiction of choice for the offshore world. Currently, BVI accounts for over 400,000 companies.

And then you have, Anguilla — the lowest cost option for corporate registration.

Of course, there are many other banking options in UK territories to consider, and there’s more to Cayman, BVI, and Anguilla than their deposits, companies registered, or cost.

So, to help answer the question “Where should I open a bank account?” we’ll look at each of the offshore satellites below — and share some insights on where they excel and where they fail.

Here are the specific territories that we’ll cover throughout the rest of the article:

- Bailiwick of Guernsey

- Isle of Man

- Bailiwick of Jersey

- Anguilla

- Bermuda

- British Virgin Islands

- Cayman Islands

- Gibraltar

Note: if these jurisdictions are not suitable for your banking needs, or they don’t provide the services you’re after and you would like to look at opening bank accounts outside of the Uk, don’t worry. There are other options to consider. If you would like to open accounts in the UAE as a non-resident for example, it is 100% possible. That said, account opening in the UAE doesn’t come easy. You need to understand the requirements for opening accounts in the UAE as a non-resident.

For now, let’s look at each territory in detail. That way, you can make an informed decision on whether or not opening accounts offshore in the UK is right for you.

Offshore Banking in Guernsey (Crown Dependency)

Guernsey’s financial services industry caters to wealth management, trusts and foundations, insurance companies, funds, and bond issuers.

Not surprisingly, most local service providers focus on financial services and various facets of trust administration and management, corporate formation, structuring, investment advisory, captive insurance entities, and related services.

Thanks to Guernsey’s low taxes, beneficial laws, clean image, and high concentration of specialized financial services, it’s a popular jurisdiction for institutional investors and individuals with significant wealth.

Today, there are over 20,000 trusts registered in Guernsey, 30% of Europe’s junk bonds are issued here, and Guernsey is an important launching pad for companies planning to list on the London Stock Exchange. So, there’s a lot happening.

When it comes to opening an offshore account here, Guernsey is a destination for private banking and wealth management services for high-net-worth individuals (HNWI), ultra-high-net-worth individuals (UHNWI), their businesses, and wealth planning vehicles.

In some cases, it’s possible to access certain non-resident and expat banking services, ranging from standard international bank accounts and wealth management to international mortgages for property in the UK. However, financial institutions are selective, so choosing the right place to apply is critical.

Overall, opening bank accounts in Guernsey is a good fit for those in higher wealth brackets willing to make larger deposits. It’s also a useful hub for Guernsey-administered entities and those using the island’s financial services. Of course, people and companies who have ties (or assets) in or connected to the UK can also bank here.

To learn more about opening offshore bank accounts in the UK via Guernsey, check out our Guernsey Offshore Banking Article.

International Banking in the Isle of Man (Crown Dependency)

The Isle of Man is often seen as the more cost-effective banking option among the Crown Dependencies. That’s because some Isle of Man banks are easier to access and allow lower deposits than those banks in Guernsey or Jersey.

That said, it can still be challenging to open offshore accounts in the Isle of Man if you don’t have the right client profile. Likewise, not taking bank selection seriously can be a major issue. Choosing the wrong bank can result in lost time, money, and a lot of frustration.

The Isle of Man is best suited to non-residents and expats living outside of their home countries. It can also be an option for UK nationals and those with UK ties. For these groups, the Isle of Man can offer stable banking in a first-world jurisdiction. Plus it has far less stigma than banking in the Caribbean.

Of course, there are other important variables you need to consider. And, opening an Isle of Man bank account isn’t available to everyone. But if you have the right information, contacts, and know which financial institutions to approach, opening offshore bank accounts here 100% remotely is entirely possible.

To learn more about opening offshore bank accounts in the UK via the Isle of Man, check out our Isle of Man Offshore Banking Article.

Opening Offshore Accounts in Jersey (Crown Dependency)

When it comes to non-resident and expat banking, Jersey is often seen as a halfway point between the Isle of Man and Guernsey — at least when it comes to depositing requirements.

If you can muster a £25,000 GBP deposit, Jersey could be worth considering. If you plan on depositing less, you may want to consider the Isle of Man instead.

Alternatively, if you’re interested in depositing significantly more, all three islands will have options available. The best choice will boil down to whether you plan on banking personally or through a structure such as a trust, company, or foundation, and what services you need.

If you’re interested in opening accounts in Jersey, bank and banker selection are critical. In other words, knowing which bank in Jersey is best suited for your specific client profile is key. This is important since not all financial institutions are interested in dealing with non-residents, offshore companies, and transactional banking.

To learn more about opening offshore bank accounts in the UK via Jersey, read our Jersey Offshore Banking Article.

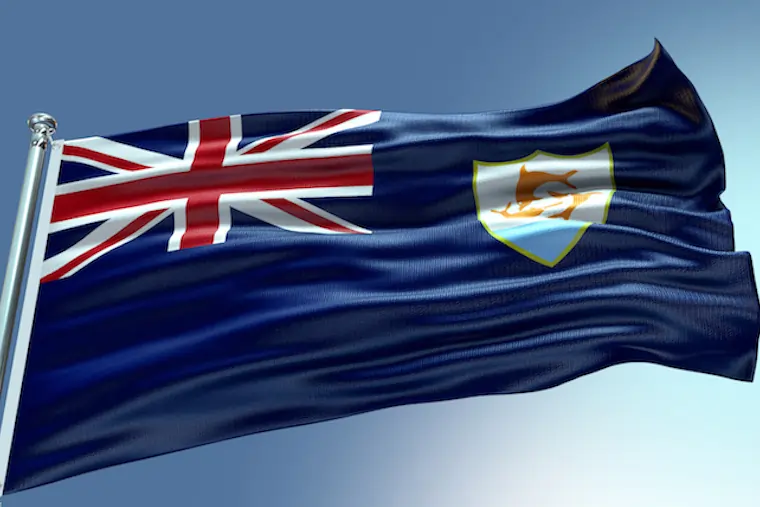

Opening an Offshore Account in Anguilla (British Overseas Territory)

Many of the other islands on this list started establishing themselves as major players in the offshore world between the 1960s and 1980s. But not Anguilla. Anguilla was drowning in conflicts, and political unrest, and busy fighting off coups. In fact, the country didn’t even achieve independence until 1982.

So, Anguilla was very late to the offshore game…

How does this impact offshore banking in Anguilla? Well, all of the other countries on this list had a 15 to 20-year head start. For example, when Cayman was being called the “Geneva of the Caribbean”, most people didn’t even know Anguilla was a country.

So, it’s no surprise that Anguilla’s offshore service industry is underdeveloped and banking options are limited. So, if you want to bank offshore, there are better options elsewhere.

The one thing Anguilla does have going for it is its strong British ties. But, without any niche or specialization to sell, Anguilla remains a lower-priced company formation hub.

For this reason, if you’re considering opening offshore bank accounts in Anguilla as an offshore option, consider other options first.

Opening an Offshore Account in Bermuda (British Overseas Territory)

Bermuda is one of the most reputable offshore financial centers in the world today. So, it’s no surprise that many people look to Bermuda to open offshore bank accounts. However, for most people, Bermuda isn’t the best choice.

That’s because Bermuda caters to multinationals, insurance companies, listed entities, trusts, and other companies used for wealth management. So, not surprisingly, financial institutions in Bermuda tend to favor opening accounts for these entities.

Of course, there are some banking options available for non-residents and foreign companies. But these tend to require higher minimum deposits, and higher annual turnover, and cater to individuals interested in wealth management.

In other words, banking options in Bermuda are limited when compared to the other territories covered in this article. For this reason, most individuals explore offshore banking in Bermuda for structuring 100-year trusts and forming exempted companies before opening accounts.

Banking Offshore in the British Virgin Islands (British Overseas Territory)

While the British Virgin Islands (BVI) are synonymous with the offshore world, they actually have very little to do with banking offshore and finance. In fact, less than 1% of offshore financial activities pass through banks in the British Virgin Islands.

Instead, this tiny Caribbean nation is internationally known for corporate registration, offshore companies, and its private company registry. In other words, the ownership of companies in the BVI is a private matter… that is until the public registry comes into effect in 2023.

That said, there are a few financial institutions in the British Virgin Islands that do offer offshore bank accounts. Not surprisingly, this includes a few of the regional players in other parts of the Caribbean as well.

In most cases, when considering banking offshore in the UK territories mentioned in this article, you’ll find better options outside BVI. And, if you have a BVI company and are struggling to open a company bank account, it’s worth noting that there are viable options available in other top banking hubs.

To learn more about opening offshore bank accounts for BVI companies, read our article on How to Find the Best Bank Account for a BVI Company.

Banking Offshore in the Cayman Islands (British Overseas Territory)

Cayman is one of the most important international banking hubs in the world. It has deep roots in offshore finance and acts as an extension of the City of London’s offshore network.

Cayman is the world’s fifth-largest financial center, home to 75% of all the world’s hedge funds, and has US $674 billion on deposit — not bad for a country of less than 60,000 people.

Like most of the territories mentioned in this article, the benefits of a Cayman Islands bank account include strong asset management and wealth management.

But, there is one major difference between Cayman and other jurisdictions: it’s very difficult to get in.

Cayman Islands banks now require (and strongly enforce) existing ties to the country. That means you (or your company) require clear and demonstrable ties to the Cayman Islands. Of course, exceptions are possible and you can obtain ties. Though in some cases, banks and bankers may be willing to accommodate looser ties than others depending on your profile.

Prospective clients should expect to deposit money of at least US $50,000 to $100,000 when opening an offshore account here. But, amounts vary and ultimately depend on the bank and banker you approach for account opening.

To learn more about opening offshore bank accounts in the UK via the Cayman Islands, read our Cayman Islands Offshore Banking Article.

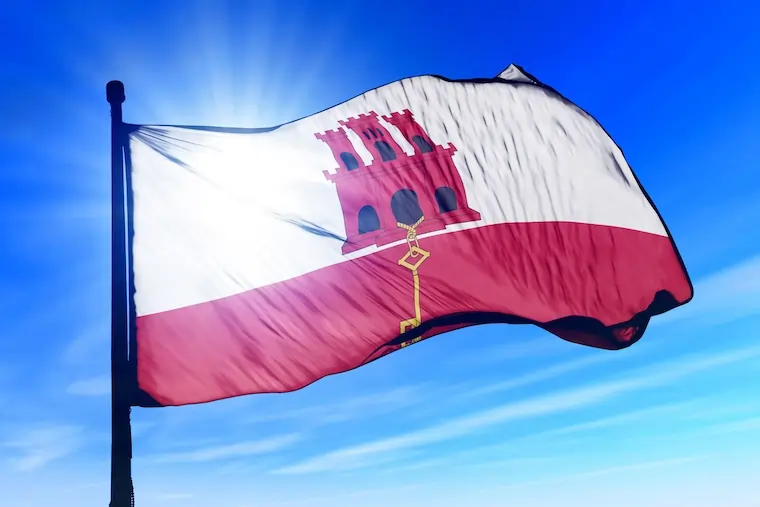

Banking Offshore in Gibraltar (British Overseas Territory)

Finally, we come to Gibraltar. Now, in the world of offshore bank accounts, Gibraltar seems to have faded into the background over the last few years. And, there’s a good reason for that, which we’ll share below.

But first, it’s worth noting that Gibraltar is best known for its non-resident companies. A lesser-known benefit is that Gibraltar is a territorial tax jurisdiction… in Europe. Additionally, it can lead to UK citizenship. Meaning it offers a safe and stable place to live and bank.

So, it’s no surprise that banks in Gibraltar specialize in private banking and wealth management services. That means, banks here cater to high-net-worth individuals, non-residents, companies, and trusts. Of course, part of the attraction to Gibraltar is that it offers a solid reputation. It also doesn’t suffer from tax haven stigma anymore.

Unfortunately, Gibraltar is becoming significantly more difficult to access for non-residents looking to open offshore bank accounts. That is unless you’re looking to open a mid-six-figure account with one of the available private banking options.

Those looking for transactional banking in Gibraltar will either need ties or a Gibraltar-registered entity. And, those willing to consider banking alternatives can also consider Gibraltar-based fintech or licensed e-money institutions (or EMIs).

That said, if you’re taking your first step into opening offshore bank accounts, don’t have any ties to the UK or Gibraltar, and are looking to make a deposit below £500,000, you may want to consider one of the other options listed above or another jurisdiction for banking offshore purposes.

To learn more about opening offshore bank accounts in the UK via Gibraltar, read our latest Gibraltar Offshore Banking Article.

Frequently Asked UK Offshore Banking Questions

Below are a few of the most common questions we receive from people exploring offshore banking in the UK. If you have further questions about online offshore banking, don’t hesitate to contact us directly.

Is It Legal to Have an Offshore Bank Account in the UK?

Yes, it is legal to have an offshore bank account in the UK. However, individuals need to correctly disclose and report their offshore accounts to relevant government and tax authorities in their country of citizenship and residency when required. If you are not clear on whether you need to disclose or report offshore accounts, you should contact a qualified advisor or accountant to confirm your obligations.

Is It Illegal to Have Offshore Bank Accounts?

No, it is NOT illegal to have offshore bank accounts. It is, however, illegal to have an offshore bank account that is used for evading taxes, money laundering, or other financial crimes.

How Much Money Do You Need to Open an Offshore Bank Account?

To open an offshore bank account, you will need to make a qualifying deposit between USD 10,000 and USD 1mm. The specific amount required to open an offshore account will vary depending on the jurisdiction, bank, account type, and client profile. It’s important to confirm the deposit requirement you will need to meet before applying for an offshore bank account.

Can I Have a UK Bank Account If I Live Abroad?

Yes, you can have a UK bank account if you live abroad. However, domestic UK banks have strict requirements for proof of address, local phone numbers, and in-person account opening applications. With this in mind, applying for an account outside of the UK in one of the British Overseas Territories is often more suitable to foreign non-residents.

Do You Want Help Opening Offshore Bank Accounts?

If so, you can access GlobalBanks Insider and start the process of applying for an offshore account in a few clicks.

GlobalBanks Insider is a dedicated account opening solution that involves direct support from our team and direct introductions to the banks of your choosing. It gives you instant access to the…

+ Direct support from a team of banking experts

+ Direct introductions to your desired banks

+ Answers to your most pressing questions and challenges

+ Expert insights on which banks to choose & why

+ Plus, FULL access to our entire suite of account opening tools and intelligence!

And “yes!” GlobalBanks Insider is designed to help foreign and non-resident individuals and companies open bank accounts.

Use this link to see how GlobalBanks Insider can help you successfully open accounts.